SHARE

Financial literacy is a matter of concern not just for investors but for the general public as well. If you are an employer, it is advisable for you to get a better understanding of the financial literacy of your employees.

Why?

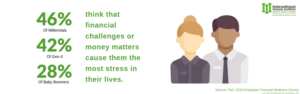

Because in companies all over the world, financially unstable or financially insecure employees are the source of low productivity and reduced efficiency at the workplace. It’s a no-brainer that an engaged and stress-free workforce will be more productive and bring more value to the organisation in comparison to a team of financially stressed employees.

An employee who doesn’t have their finances in order is more prone to absenteeism and performing poorly at important tasks. However, the onus of learning more about finance lies not just with the employee but with the employer as well. As much as every working professional must find ways to remain aware of their finances, employers can play a major role in making sure that their workforce is financially-empowered. The easiest way to do this is to look at financial literacy as a necessary part of your employees’ lives.

Companies have the power to positively influence their staff into making better financial decisions for themselves. A business must take the responsibility to enable its people to face financial challenges without affecting their personal well-being and their motivation to work at their full potential. It also helps to build a personal bond which may make employees stick around for longer periods of time.

However, just providing information about finance is not going to be enough. The world of finance is complicated, it’s what keeps people from trying to understand it in the first place. You need to run a holistic financial wellness and literacy plan that is engineered to give long-lasting results for both your business and your employees.

Why Should I Run A Financial Literacy Program?

While the reasons mentioned earlier somewhat elucidate the need for financial literacy at the workplace, it’s important to understand exactly how such programs bring value to the workplace.

From the employee’s perspective – Most working professionals have almost no idea what they should be doing with their finances now that they have a regular source of income. In today’s age, we see many people struggling with economic stability as they live paycheck-to-paycheck. Most adults do not have adequate knowledge of filing taxes, starting a savings fund, or invest the money lying in their bank.

Numerous employees are unaware of the financial benefits offered by their employers as well. By receiving financial education at the workplace, employees are able to get more comfortable with managing their money, especially since it happens right at the source of their income. They are also able to make use of employer benefits and figure out a way to integrate them into their personal financial plans.

From the employer’s perspective – By playing an active role in your employee’s financial well being, you as an employer stand to gain more than just a worry-free workforce. In companies where financial literacy is a norm, employees are less likely to attrite, and more likely to show up to work more often. By reducing their stress levels, you are effectively reducing medical expenses incurred both by your employees and the business. A major point to be noted is that financial literacy programs make employees better prepared for retirement. This ensures that there are no employees working beyond the retirement age unless they really want to.

The importance of financial literacy in the workplace cannot be underplayed anymore. With more people joining their ranks every year, it’s imperative that businesses include financial literacy as an integral part of their company culture.

Start your personal wealth journey with us today!

Plan to Maximize Your Retirement Years

October 4, 20180 Comments

Leave a Reply

- 2019

- 2020

- Awards

- Banking

- Budget

- Cashflow Management

- CORPORATE

- Corporate Wellness

- Couple

- Cross Border Financial Planning

- Dreams

- FAQ

- FINANCE

- Financial Goal

- Financial Planning

- FINANCIAL TRANSITIONS

- FINANCIAL WELLNESS

- Goals

- Holidaying

- Housing

- Insurance

- Investment

- Market

- Money

- Mutual Funds

- NRI

- Portfolio

- Real Estate

- Retirement

- Risk Management

- Rupee

- Succession Plan

- Tax Planning

- Tax Return

- Technology

- Wealth Management

- Women

Categories

Financial literacy is a matter of concern not just for investors but for the general public as well. If you are an employer, it is advisable for you to get a better understanding of the financial literacy of your employees.

Why?

Because in companies all over the world, financially unstable or financially insecure employees are the source of low productivity and reduced efficiency at the workplace. It’s a no-brainer that an engaged and stress-free workforce will be more productive and bring more value to the organisation in comparison to a team of financially stressed employees.

An employee who doesn’t have their finances in order is more prone to absenteeism and performing poorly at important tasks. However, the onus of learning more about finance lies not just with the employee but with the employer as well. As much as every working professional must find ways to remain aware of their finances, employers can play a major role in making sure that their workforce is financially-empowered. The easiest way to do this is to look at financial literacy as a necessary part of your employees’ lives.

Companies have the power to positively influence their staff into making better financial decisions for themselves. A business must take the responsibility to enable its people to face financial challenges without affecting their personal well-being and their motivation to work at their full potential. It also helps to build a personal bond which may make employees stick around for longer periods of time.

However, just providing information about finance is not going to be enough. The world of finance is complicated, it’s what keeps people from trying to understand it in the first place. You need to run a holistic financial wellness and literacy plan that is engineered to give long-lasting results for both your business and your employees.

Why Should I Run A Financial Literacy Program?

While the reasons mentioned earlier somewhat elucidate the need for financial literacy at the workplace, it’s important to understand exactly how such programs bring value to the workplace.

From the employee’s perspective – Most working professionals have almost no idea what they should be doing with their finances now that they have a regular source of income. In today’s age, we see many people struggling with economic stability as they live paycheck-to-paycheck. Most adults do not have adequate knowledge of filing taxes, starting a savings fund, or invest the money lying in their bank.

Numerous employees are unaware of the financial benefits offered by their employers as well. By receiving financial education at the workplace, employees are able to get more comfortable with managing their money, especially since it happens right at the source of their income. They are also able to make use of employer benefits and figure out a way to integrate them into their personal financial plans.

From the employer’s perspective – By playing an active role in your employee’s financial well being, you as an employer stand to gain more than just a worry-free workforce. In companies where financial literacy is a norm, employees are less likely to attrite, and more likely to show up to work more often. By reducing their stress levels, you are effectively reducing medical expenses incurred both by your employees and the business. A major point to be noted is that financial literacy programs make employees better prepared for retirement. This ensures that there are no employees working beyond the retirement age unless they really want to.

The importance of financial literacy in the workplace cannot be underplayed anymore. With more people joining their ranks every year, it’s imperative that businesses include financial literacy as an integral part of their company culture.

Start your personal wealth journey with us today!

0 Comments

0 Comments