SHARE

As you all know, inflation causes prices to increase and purchasing power parity to decrease. What this means is that, for example, if INR 500 could get you 50 units of a particular product today, the same amount might only fetch 40 units in a few years. So, what implications does this have for you as an investor? While estimating your gains/profits, using the Cost Inflation Index (CII) can help you reduce the tax levied on the sale of your long-term capital assets. Keep reading to find out how.

What are capital gains?

Before we can understand how to use CII, we need to have a general understanding of capital gains. Broadly speaking, capital gains are the profits you reap from the sale of capital assets; like cars, properties, stocks, bonds, art, antiques and other such things. Based on how long you have held the asset, the proceeds generated from its sale is either categorised as a short- or long-term capital gain. Apart from assets like equities, preference shares, debentures, bonds, equity mutual funds and so on – for which the time period is 12 months – all other assets are considered long term holdings if they have been in your possession for 36 months.

Capital gains tax

The government levies a tax on gains made from the sale of both short- and long-term capital assets. This is known as capital gains tax. Apart from the sale of securities, short term capital gains are added to your income and taxed according to the particular slab you fall under. Securities sale in the short term are taxed at 15%. In the long term, assets like equities and shares are taxed at 10% when the profits exceed INR 1 lakh; other assets are taxed at 20%. For the purpose of understanding CII, we are particularly interested in the long-term capital gain tax only.

Cost Inflation Index

Indexation is a process by which individuals can protect their earnings against tax erosion. CII is an extension of this idea into the sphere of capital gains, particularly long-term capital gains. In this sense, CII helps you reduce the taxable amount on your long-term capital gains by calculating the increase in the price of your assets due to inflation, and accounting for the same in the sale. What this means is that CII allows you, as an investor, to report a reduced capital gain from the sale of long-term capital assets by incorporating changes in the price caused by inflation. Then since the reported value of the capital gains decreases, so does the applicable tax on those gains. Here it is important to note that the Central Board of Direct Taxes (CBDT) notifies the CII every year in the official gazette, calculated using the base year as 2001; i.e. CII for 2001 will be taken as 100, and assets bought prior to this date will hold an acquisition value according to their prices in 2001.

How is CII calculated?

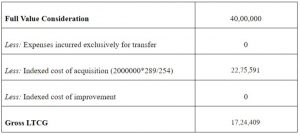

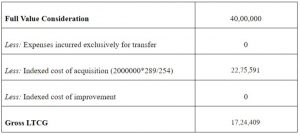

Let us say you buy a plot of land worth INR 20,00,000 in 2015 and subsequently sell it at INR 40,00,000 in 2019. According to the CBDT notification, the CII is 254 for the fiscal year 2015-16 and 289 for 2019-20. At face value, the profit you earned from this sale is seen to be INR 20,00,000. However, when the cost of purchase is adjusted for inflation using CII it will attract a lesser capital gains tax then that on INR 20,00,000. Let us understand from the table below –

So, if you plan to sell capital assets like gold, real estate, securities and so on, don’t forget to take advantage of CII and reduce your tax liabilities. However, if you haven’t undertaken these calculations before, then it would be in your best interest to consult a Certified Financial Planner or a Chartered Accountant to ensure that it is done correctly.

Start your personal wealth journey with us today!

Plan to Maximize Your Retirement Years

October 4, 20180 Comments

Leave a Reply

- 2019

- 2020

- Awards

- Banking

- Budget

- Cashflow Management

- CORPORATE

- Corporate Wellness

- Couple

- Cross Border Financial Planning

- Dreams

- FAQ

- FINANCE

- Financial Goal

- Financial Planning

- FINANCIAL TRANSITIONS

- FINANCIAL WELLNESS

- Goals

- Holidaying

- Housing

- Insurance

- Investment

- Market

- Money

- Mutual Funds

- NRI

- Portfolio

- Real Estate

- Retirement

- Risk Management

- Rupee

- Succession Plan

- Tax Planning

- Tax Return

- Technology

- Wealth Management

- Women

Categories

As you all know, inflation causes prices to increase and purchasing power parity to decrease. What this means is that, for example, if INR 500 could get you 50 units of a particular product today, the same amount might only fetch 40 units in a few years. So, what implications does this have for you as an investor? While estimating your gains/profits, using the Cost Inflation Index (CII) can help you reduce the tax levied on the sale of your long-term capital assets. Keep reading to find out how.

What are capital gains?

Before we can understand how to use CII, we need to have a general understanding of capital gains. Broadly speaking, capital gains are the profits you reap from the sale of capital assets; like cars, properties, stocks, bonds, art, antiques and other such things. Based on how long you have held the asset, the proceeds generated from its sale is either categorised as a short- or long-term capital gain. Apart from assets like equities, preference shares, debentures, bonds, equity mutual funds and so on – for which the time period is 12 months – all other assets are considered long term holdings if they have been in your possession for 36 months.

Capital gains tax

The government levies a tax on gains made from the sale of both short- and long-term capital assets. This is known as capital gains tax. Apart from the sale of securities, short term capital gains are added to your income and taxed according to the particular slab you fall under. Securities sale in the short term are taxed at 15%. In the long term, assets like equities and shares are taxed at 10% when the profits exceed INR 1 lakh; other assets are taxed at 20%. For the purpose of understanding CII, we are particularly interested in the long-term capital gain tax only.

Cost Inflation Index

Indexation is a process by which individuals can protect their earnings against tax erosion. CII is an extension of this idea into the sphere of capital gains, particularly long-term capital gains. In this sense, CII helps you reduce the taxable amount on your long-term capital gains by calculating the increase in the price of your assets due to inflation, and accounting for the same in the sale. What this means is that CII allows you, as an investor, to report a reduced capital gain from the sale of long-term capital assets by incorporating changes in the price caused by inflation. Then since the reported value of the capital gains decreases, so does the applicable tax on those gains. Here it is important to note that the Central Board of Direct Taxes (CBDT) notifies the CII every year in the official gazette, calculated using the base year as 2001; i.e. CII for 2001 will be taken as 100, and assets bought prior to this date will hold an acquisition value according to their prices in 2001.

How is CII calculated?

Let us say you buy a plot of land worth INR 20,00,000 in 2015 and subsequently sell it at INR 40,00,000 in 2019. According to the CBDT notification, the CII is 254 for the fiscal year 2015-16 and 289 for 2019-20. At face value, the profit you earned from this sale is seen to be INR 20,00,000. However, when the cost of purchase is adjusted for inflation using CII it will attract a lesser capital gains tax then that on INR 20,00,000. Let us understand from the table below –

So, if you plan to sell capital assets like gold, real estate, securities and so on, don’t forget to take advantage of CII and reduce your tax liabilities. However, if you haven’t undertaken these calculations before, then it would be in your best interest to consult a Certified Financial Planner or a Chartered Accountant to ensure that it is done correctly.

Start your personal wealth journey with us today!

0 Comments

0 Comments