SHARE

Many new investors might not have the means to invest lump sums into a mutual fund or a fixed deposit at a single instance. In such cases, the most popular routes for investing are through a Systematic Investment Plan (SIP) or Recurring Deposit (RD), which allow you to invest small amounts over a predetermined time frame, at a varying frequency. In this article we will look at the differences between these two schemes.

What is SIP and RD?

Before we look at the differences between SIP and RD and begin comparing them, it will be good to briefly go over a few of their basic features independently.

- Recurring Deposit (RD): In an RD, you make monthly deposits at a bank or post office for a predetermined time frame. This period of time ranges from six months to ten years. Since the rate of interest is fixed on RDs, you will be able to calculate the amount payable to you at the end of the tenure when you make the initial investment.

- Systematic Investment Plan (SIP): SIP is a route through which you can invest in mutual funds where payments are made at a time period of your choosing – usually weekly, monthly or quarterly. You also choose the end date for your SIP, which is generally between three to five years; but can be longer too. This period can also extend indefinitely if you opt for perpetual SIP, where the scheme’s end date will be December 2099 by default, unless you close the account earlier.

What are the differences between SIP and RD?

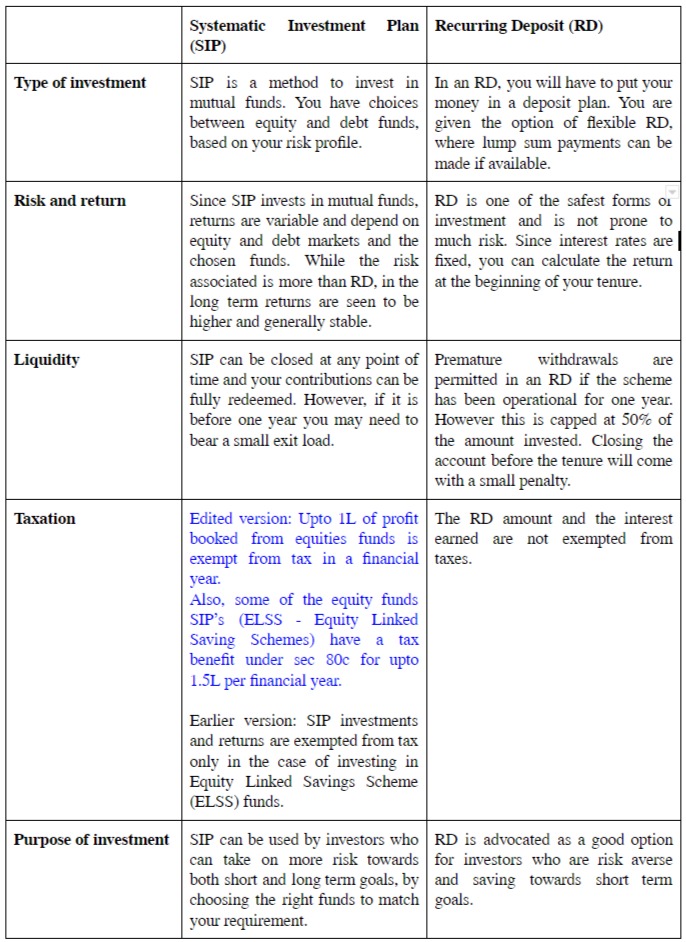

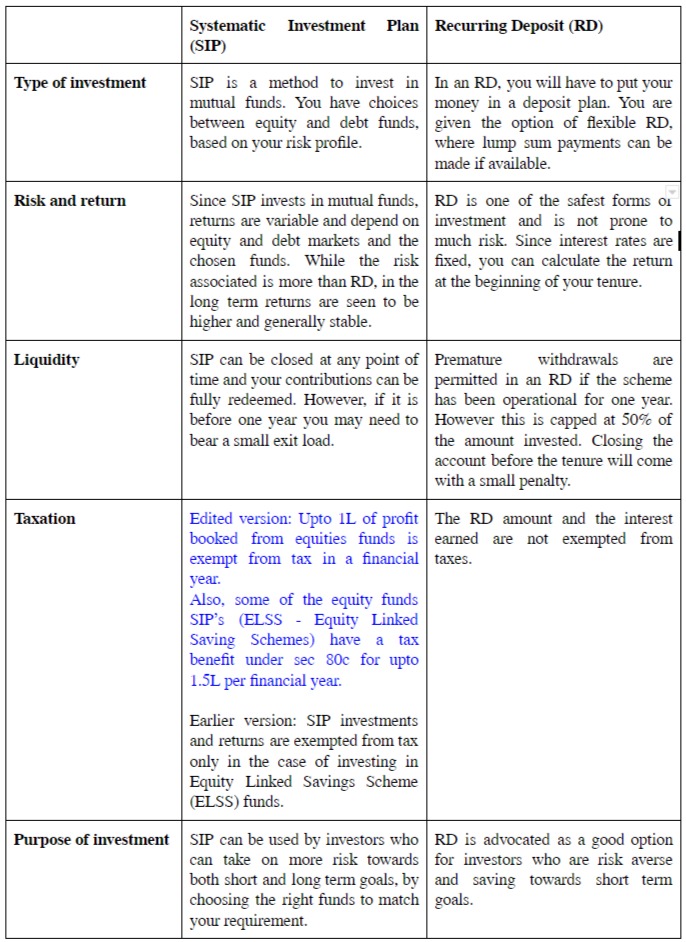

While SIP and RD may look structurally similar, here are the main differences between the two forms of investment that you need to know:

Both SIP and RD have their own benefits and limitations. The scheme that you choose will depend on the goal that you are planning towards and the amount of risk you can take on as an investor. So to ensure that you are making the right move for your portfolio, don’t forget to consult your financial advisor before making a decision.

Start your personal wealth journey with us today!

Plan to Maximize Your Retirement Years

October 4, 20180 Comments

Leave a Reply

- 2019

- 2020

- Awards

- Banking

- Budget

- Cashflow Management

- CORPORATE

- Corporate Wellness

- Couple

- Cross Border Financial Planning

- Dreams

- FAQ

- FINANCE

- Financial Goal

- Financial Planning

- FINANCIAL TRANSITIONS

- FINANCIAL WELLNESS

- Goals

- Holidaying

- Housing

- Insurance

- Investment

- Market

- Money

- Mutual Funds

- NRI

- Portfolio

- Real Estate

- Retirement

- Risk Management

- Rupee

- Succession Plan

- Tax Planning

- Tax Return

- Technology

- Wealth Management

- Women

Categories

Many new investors might not have the means to invest lump sums into a mutual fund or a fixed deposit at a single instance. In such cases, the most popular routes for investing are through a Systematic Investment Plan (SIP) or Recurring Deposit (RD), which allow you to invest small amounts over a predetermined time frame, at a varying frequency. In this article we will look at the differences between these two schemes.

What is SIP and RD?

Before we look at the differences between SIP and RD and begin comparing them, it will be good to briefly go over a few of their basic features independently.

- Recurring Deposit (RD): In an RD, you make monthly deposits at a bank or post office for a predetermined time frame. This period of time ranges from six months to ten years. Since the rate of interest is fixed on RDs, you will be able to calculate the amount payable to you at the end of the tenure when you make the initial investment.

- Systematic Investment Plan (SIP): SIP is a route through which you can invest in mutual funds where payments are made at a time period of your choosing – usually weekly, monthly or quarterly. You also choose the end date for your SIP, which is generally between three to five years; but can be longer too. This period can also extend indefinitely if you opt for perpetual SIP, where the scheme’s end date will be December 2099 by default, unless you close the account earlier.

What are the differences between SIP and RD?

While SIP and RD may look structurally similar, here are the main differences between the two forms of investment that you need to know:

Both SIP and RD have their own benefits and limitations. The scheme that you choose will depend on the goal that you are planning towards and the amount of risk you can take on as an investor. So to ensure that you are making the right move for your portfolio, don’t forget to consult your financial advisor before making a decision.

Start your personal wealth journey with us today!

0 Comments

0 Comments